Author: Giovanny Cardona Montoya

Translator: Andrés Fernando Cardona Ramírez

Spanish version: http://www.elcolombiano.com/blogs/lacajaregistradora/?p=1584

Remembrance:

I had the pleasure of living seven years in Ukraine, one in Kharkov and six in Kiev. I remember the industrial Kharkov and wonderful university and cultural city: Kiev. But many things have changed since that beautiful time. Beautiful, despite the huge scare that we got from the Chernobyl accident in 1986; just 141 km from the nuclear reactor.

Short historical review of Ukraine

The union of nations between Russia and Ukraine is historically so strong that the first was born in Kiev, the capital of the second. The Kievskaya Rus was over a thousand years ago, the cradle of the Slav peoples of Russia, Belarus and Ukraine.

The history of Europe is full of wars, and Ukraine is not immune to this reality. In this context, the country has been divided and re- united more than once over the centuries.

In the eighteenth century, under the Partitions of Poland, Eastern Ukraine was annexed to the Russian Empire and the West to Austria. In 1917, after the disappearance of the Russian Empire, Ukraine became independent but divided into two: the axis of which was the city of Lvov, and which had the capital Kiev. In 1918, the Eastern Ukraine came to be part of the nascent Soviet Union, and the one which had as its axis Lvov was annexed by Poland.

This division persisted until 1939, as a result of the Secret Pact between Hitler and Stalin, the Soviet Union annexed Lvov and the Ukrainian territories that were part of Poland. In 1954, the Soviet Republic of Ukraine was defined by the current borders, including the Crimea, axis of the near attempto of war between Russia and Ukraine in the beginning of March 2014.

The Ukrainian economy

Ukraine is a country of 45 million habitants and a GDP of 340 billion dollars ( 2012). Although the service sector is the largest employer ( 58 % in 2012 ), its exports focus on the foundry industry (steel) and agriculture . Ukraine has land that is fertile and easy to machine , and is dedicated to the production of wheat, barley and maize , the latter with a growing share of rural GDP.

On the side of mining are important reserves of coal, iron , uranium and gold. At the industry level, in addition to the steel foundry, Ukraine has produced chemicals and many shipyards. The legacy of the Soviet Union industry ( aircraft production , tools, arms) is rather inefficient and costly from the perspective of energy consumption. Its challenge is to enable the industry to diversify its productive apparatus.

Ukraine: between the European market and the Russian fuel.

Although many analysts name the cultural differences of the Ukrainians to explain the current crisis ( a Catholic Western Ukrainian language and Ortodox Russophile East) , and fractures caused by political corruption in this Slavic country , it is legitimate to suggest geopolitics and geo-economics help explain much of the current problems and risks ahead.

The current crisis in Ukraine suggests two potential risks. For starters, a possible armed confrontation between Russia and Ukraine is explained, not by the intention of Putin to protect the integrity of the Russian population of Crimea, but especially for the defense of its Black Sea Fleet, quartered in the region. This military enclave is supported by an agreement between the two nations, in which the base is rented to the Russians until 2042 in exchange for 40 billion dollars in discount gas prices for 10 years.

The other risk is a new division of Ukraine, maintaining an eastern region, centered on Kiev, allied with Russia and a western that would enter the European Union. On this point it should be noted that the Geo-economics is a central argument.

In aggregate terms, Russia is the largest trading partner of Ukraine (21 % of exports and 28 % of imports). On the one hand, Ukraine depends on Russian fuel supply, 3 /4 of the oil and gas and 100% of nuclear energy consumed are imported from Russia. On the other, Russia´s need of the foundry and agricultural products Ukraine provides. Recall that in the era of socialism, Ukraine produced 25 % of the grains of the Soviet Union.

While Ukraine’s trade relations with Western Europe are not significant (Germany is the major supplier and Turkey is the second market) it is clear that Ukraine´s potential would not be negligible for the future of the European Union: abundant labor, laborious and low cost, a potential 45 million people market, fertile soils, coal reserves and metal foundries, are attractive for any economy looking to get out the long crisis which has lived in the Eurozone since 2008.

But, surely, it´s the mixture of Geopolitics and Geo – economics that best highlights the confrontation between the West and Russia for their leverage over Ukraine. To begin let’s say that the West European powers have extended their zone of influence up to Moscow. With the exception of Ukraine and Belarus, the western border of Russia has migrated to the European bloc.

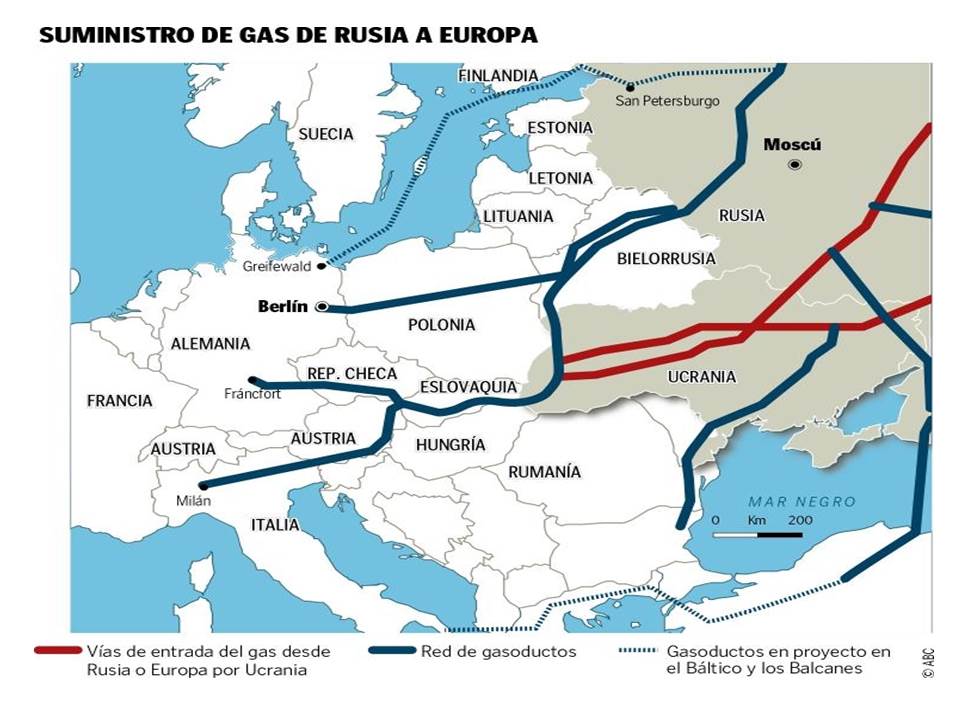

From the Russian perspective , there is an additional interest : its pipelines. Ukraine depends not only on supply but is a supplying pipeline route to Western Europe. Keeping Ukraine as an ally, allows Russia to handle trading strategies with their Western customers. History has shown that the European Union is vulnerable when Russia gets “tough” negotiating gas supply … especially if it is winter.

From the Russian perspective , there is an additional interest : its pipelines. Ukraine depends not only on supply but is a supplying pipeline route to Western Europe. Keeping Ukraine as an ally, allows Russia to handle trading strategies with their Western customers. History has shown that the European Union is vulnerable when Russia gets “tough” negotiating gas supply … especially if it is winter.

Source: http://www.armandobronca.com/gasoductos-del-este_1018/

Source: http://www.armandobronca.com/gasoductos-del-este_1018/